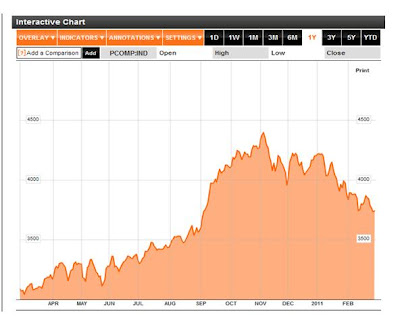

Many investors now are thinking what would be the future of Philippine Stocks for year 2011. As we are observed for the performance of PSEI after it breaks the record high during month of November 2010 last year it cannot hold or maintain the position at 4,000 levels since 2nd week of January to end of February. The question is, is it temporary only? Is it a correction for a bull market run? Or it will continuously go down same as what happen in previous recession that shocks the world in 2008?

Political Concern

We are aware what is happening now in Middle East and North Africa. People are making protest to stop the long term autocratic regime. Tunisia and Egypt was successfully removed their leader after many days of protests. This became an example for nearby country with similar form of government like Bahrain, Libya, Oman, Yemen, Iraq and even Saudi Arabia is not spare with this political unrest. We didn’t know exactly what will be substantial effect of these conflicts for Philippine market given that this country has direct effect for our oil supply and remittances from OFW. Saudi Arabia’s King Abdullah already made programs to help people, such as increase of salary for government’s employees, zero interest housing, jobs for all Saudi National and debt forgiveness. We hope that this political unrest will finish in short term.

High Inflation

The current situations now in Arab countries with political unrest tend to make the price of oil up by more than $100 per barrel. Philippine industry uses oil for transportation, industrial processing and manufacturing. Big percentage of Philippines requirement for oil is thru importation and this is the reason why any movement of oil price has direct effect to our inflation. Back in 2008, the country posted an average inflation rate of 10.4 percent, the highest in the past decade. This year Swiss investment bank UBS said the country's inflation rate may average 4.1 percent this year, from 3.8 percent last year.

Condition of Philippine Economy

Considering the status of Philippine economy, experts are saying that we are in healthy condition given the strong fundamentals, having the momentum of high economic growth last year with 7.3% GDP growth which is above the government’s target of 5-6% supported by high remittances from OFW that rose by 8.2% to $18.763 billion. Actually, the projection for economic growth of Philippines for year 2011 is also good but lower than what we gain last year. Another factor is the strong confidence of businessman that our economy is good for year 2011. Also, our president has strong support from the people, making good economic reforms and anti-corruption policy in government offices.

What we should do?

Perhaps each kind of investor now is doing their part to study fundamentals and technical aspect of their stocks or stocks related portfolio such as mutual funds and UITF, factoring also the socio-political situations in Arab country in mid-east with political unrest.

In my personal opinion, this time is good opportunity to buy since the level of PSEI is already in 3700 mark. The strategy is to buy blue chip stocks which are oversold and with strong fundamentals. Or buy mutual funds or UITF with stocks in nature choosing the company with good historical performance.

No comments:

Post a Comment